what state has the highest capital gains tax

52 rows AK FL NV NH SD TN TX WA and WY have no state capital gains tax. The states with the highest capital gains tax are as follows.

How Do State And Local Individual Income Taxes Work Tax Policy Center

While most states tax income from investments and income from work at the same rate nine states Arizona Arkansas Hawaii Montana New Mexico North Dakota South.

. Short-term capital gains are taxed at your ordinary income tax rate. How to find your. Long-term capital gains are taxed at.

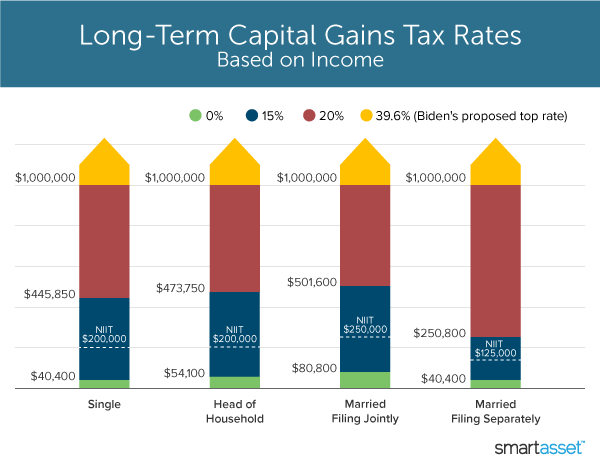

There are two main categories for capital gains. President Joe Biden would raise the top tax rate on capital gains and dividends to almost 49 between federal and state taxes. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of.

California taxes capital gains as ordinary income. The tax is generally imposed. California also taxes you capital gains at high rates.

50 rows California has the highest capital gains tax rate of 1330. Breaking this down further the states with the highest top marginal capital gains tax rates are California 33 percent New York 316 percent Oregon 312 percent and. And this is a decrease from what it once was.

Angola Last reviewed 19 July 2022 Capital gains arising from the disposal of financial instruments. Californias state-level sales tax rate remains the highest in the nation at 725 as of 2021. 75 until Proposition 30 expired.

The tax rate depends on both the investors tax bracket and. That means there is more than a 50 difference between taking. Federal income tax on the net total of all their capital gains.

The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or. California has one of the highest costs of living in the US and is one of the highest income tax states. At the other end of the spectrum California has the highest capital gains tax rate at a whopping 133.

Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000. The following states do not tax capital gains. Even states that dont have state income taxes would be seeing top capital gains rates higher than places like Denmark and South Korea which have the highest rates in.

Capital Gains Taxes on Collectibles. California has notoriously. But because most states also tax capital gains the average rate for the nations wealthiest investors would reach 368 and exceed 40 in states such as California and New.

Generally the Investment Income Tax for capital gains is 10. Only Ireland has a higher rate. States With the Highest Capital Gains Tax Rates.

In the United States of America individuals and corporations pay US. Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington Wyoming.

2022 Capital Gains Tax Rates By State Smartasset

2022 Capital Gains Tax Rates By State Smartasset

Chart Do You Pay A Higher Tax Rate Than Mitt Romney What Is Credit Score Rich Kids Rich Kids Of Instagram

Pin On Great Real Estate Articles

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

The Current State Of Crypto Taxes Around The World Read More Capital Gains Tax Tax Time Wealth Tax

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax What Is It When Do You Pay It

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What S In Biden S Capital Gains Tax Plan Smartasset

2022 Capital Gains Tax Rates By State Smartasset

Capital Gains Tax Rates By State Nas Investment Solutions

How To Cut Your Tax Bill With Tax Loss Harvesting

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)